A currency future is a formal agreement outlining the predetermined price for the purchase or sale of a currency, establishing a specific date for the transaction. These contracts adhere to stringent regulations, obliging any contracting party still holding the agreement at its expiration to accept the delivery of the currency on the agreed-upon date and at the stipulated price.

A currency future is a formal agreement outlining the predetermined price for the purchase or sale of a currency, establishing a specific date for the transaction. These contracts adhere to stringent regulations, obliging any contracting party still holding the agreement at its expiration to accept the delivery of the currency on the agreed-upon date and at the stipulated price.

Dive into the dynamic realm of currency futures, where contracts outline the buying or selling price of a currency, all tied to a specific future date. Immerse yourself in this highly regulated arena, where holding onto a contract at expiration means legally committing to taking delivery of the currency at the agreed-upon date and price.Uncover the potential, seize the opportunities, and navigate the complexities of currency futures with PMEX. Engage in a journey that goes beyond numbers, tapping into the pulse of global currency markets.

The disparity between a spot and futures price lies in their foundation. While a spot price reflects the current market value, a futures price is contingent on a projected market value in the future. When an investor engages in a trade involving a spot currency rate, they might employ a currency futures contract as a safeguard against risks associated with foreign exchange fluctuations.

A nation with a robust economy and attractive investment prospects tends to possess a strong currency, as global companies and investors seek to capitalize on the opportunities within that country. The currency's value is primarily influenced by two key factors: the monetary policy of the central bank and the trade balance. An accommodative monetary policy, characterized by low-interest rates, has a negative impact on a currency. This is because the central bank aggressively injects new currency reserves into the market, and foreign investors are not enticed by the low returns associated with these rates

Conversely, a restrictive monetary policy, marked by high-interest rates, has a positive effect on a currency. This is attributed to the limited supply of new currency reserves and the alluring interest rate returns for foreign investors.

A currency experiences a bullish trend with a current account surplus, reflecting a net inflow of the currency. On the flip side, a current account deficit exerts bearish pressure on a currency due to the net outflow of the currency. Additionally, currency values are influenced by the economic growth and investment prospects of the country.

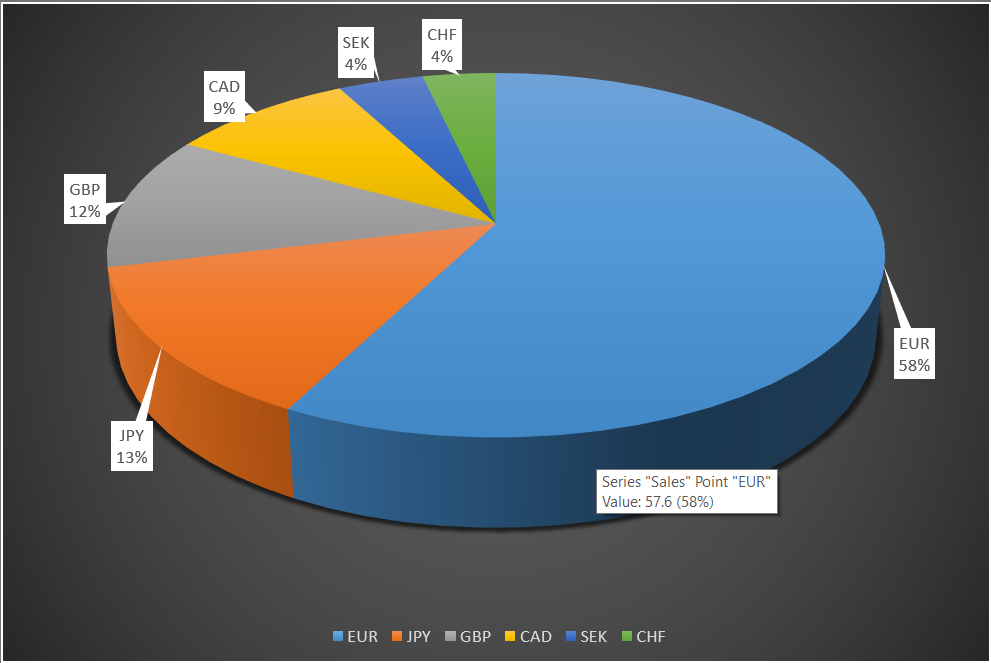

Our latest financial analysis reveals a significant pattern in the currency distribution for global sales. The Euro (EUR) stands out as the dominant currency, accounting for a substantial 58% of total sales. This dominance underscores the Euro's strong presence in international trade and its widespread acceptance as a transaction currency.

Trailing behind, the Japanese Yen (JPY) represents 13% of sales, showcasing Japan's influential role in the global economy. The British Pound (GBP), with 12%, reflects the UK's significant economic footprint and the currency's historical prominence.

The Australian Dollar serves as the official currency of the Commonwealth of Australia, encompassing various territories and independent Pacific Island states. Internationally, it is often abbreviated with the dollar sign ($) and distinguished within Australia with the symbol A$. It is divided into 100 cents

Following the replacement of pounds, shillings, and pence with decimal currency on February 14, 1966, numerous names were considered for the new currency. Prime Minister Sir Robert Menzies advocated for "the royal," but public preference led to the adoption of the dollar over alternatives like the austral, oz, boomer, roo, kanga, emu, digger, kwid, dinkum, and ming. The futures contract for the Australian Dollar provides a platform to assess its value relative to the U.S. Dollar, manage risks associated with currency rate fluctuations, and capitalize on profit opportunities arising from rate changes

The British Pound, also known as pound sterling, holds the distinction of being the world's oldest currency still in active use, with origins dating back to Anglo-Saxon England in the mid-8th century. It serves as the official currency for the United Kingdom, its Crown Dependencies, and the British Overseas Territories. Ranking as the fourth most traded currency globally following the U.S. Dollar, Euro, and Japanese Yen. It also holds the position as the third most held reserve currency in global reserves.

The currency futures contract for the British Pound offers a platform for evaluating the U.S. Dollar's relative value against the pound. Additionally, it facilitates the management of risks linked to currency rate fluctuations in the currency markets and enables the exploitation of profit opportunities arising from changes in rates.

In the realm of international trade and finance, the pound sterling plays a crucial role. Its stability and global recognition make it a preferred currency for many international transactions and investments. The London foreign exchange market, where the pound is heavily traded, is one of the largest and most significant financial markets worldwide, influencing global exchange rates and financial policies.

Moreover, the British Pound futures market is a barometer for investor sentiment regarding the UK's economic prospects. Movements in the futures market can reflect expectations about monetary policy decisions made by the Bank of England, shifts in economic performance, or reactions to political events in the UK.

The inception of the Canadian Dollar in 1871 marked a transition from the diverse local currencies used across Canadian provinces. Since 1970, the Canadian Dollar's value has been subject to a floating exchange rate, securing its position as the seventh most traded currency globally. Similar to the U.S., the term "buck" is colloquially used in Canada to refer to a dollar, a term that originated from describing the value of a beaver pelt in the 17th century.

The Canadian Dollar futures contract serves as a tool for evaluating the relative value of the U.S. Dollar against the Canadian Dollar. Additionally, it aids in managing risks linked to currency rate fluctuations in the currency markets and facilitates the exploration of profit opportunities arising from changes in rates.

Introduced in 1999 as the unified currency of the European Union, the Euro is presently utilized by 17 countries and ranks as the second most traded currency globally, following the United States Dollar.

A nation boasting a robust economy and attractive investment prospects generally experiences a strengthened currency, as global companies and investors seek to capitalize on the opportunities within that country

The Euro currency futures contract serves as a means to evaluate the relative value of the U.S. Dollar against the Euro. Additionally, it aids in managing risks associated with currency rate fluctuations in the currency markets and provides an avenue to leverage profit opportunities arising from changes in rates.

Furthermore, the Euro futures market offers opportunities for speculation. Traders can use their insights into the European economic outlook, policy decisions by the European Central Bank (ECB), and other macroeconomic factors to make informed predictions about the Euro's movement against other currencies.

As the Eurozone continues to navigate various economic challenges and opportunities, the Euro remains a symbol of European financial unity and resilience. Its role extends beyond the boundaries of the EU, impacting global markets and international economic relationships. The Euro's influence on the world stage underscores its significance as a major currency in the intricate tapestry of global finance.

The Yen became Japan's official currency in 1871 under the Meiji government, simplifying the complex currency system of the Edo period. Since the collapse of the Bretton Woods system and the shift to floating exchange rates, the Japanese Yen's value has similarly floated. However, due to its floating exchange rate, the Japanese Yen is considered highly volatile.

Ranking as the third most traded currency globally, the Yen's popularity is likely influenced by its perceived undervaluation compared to the US Dollar and British Pound. Key factors impacting a currency's value include central bank monetary policy and the trade balance.

The Japanese Yen futures contract serves as a tool for evaluating the relative value of the U.S. Dollar against the Japanese Yen. It aids in managing risks linked to currency rate fluctuations in the currency markets and provides a means to capitalize on profit opportunities arising from changes in rates.

The Swiss Franc, established in 1798 by Swiss cantons, became the official monetary unit of Switzerland and Lichtenstein in 1859 when the issuance of money was centralized to the federal government. Recognized as one of the world's strongest currencies, the Swiss Franc is renowned for its low volatility and minimal correlation with returns on foreign assets. Traditionally viewed as a 'safe-haven currency,' the Swiss Franc experiences almost zero inflation. As the sixth most traded currency globally, Swiss bank notes feature all four national languages, including German, French, Romansh, and Italian. The Swiss Franc futures contract serves as a tool to evaluate the relative value of the U.S. dollar against the Swiss Franc. It aids in managing risks related to currency rate fluctuations in the currency markets and offers opportunities to capitalize on profit potential arising from changes in rates. The Swiss Franc is occasionally denoted as CHF, representing the foederatio Helvetica Franc.

The U.S. Dollar Index futures contract stands as a prominent benchmark for assessing the international value of the U.S. Dollar, recognized as the most widely traded currency index globally. This contract allows market participants to track fluctuations in the U.S. Dollar's value relative to a basket of world currencies and provides a means to hedge portfolios against the risk of dollar movements.

Introduced on November 20, 1985, on the Financial Instruments Exchange, a division of the New York Cotton Exchange, the U.S. Dollar Index initially comprised a geometrically weighted average of ten currencies. Each currency represented a country considered a major trading partner with the United States. Presently, the index consists of a geometrically weighted average of six currencies: Euro, Yen, Pound, Canadian Dollar, Swedish Krona, and Swiss Franc.